Profitability, taxation, location: the winning trio for a successful rental investment

Rental investment in ski resorts is attracting more and more property owners seeking a real estate investment that is profitable, long-term, and emotionally rewarding. In Les Menuires, as in other Alpine resorts, combining profitability, favorable taxation, and strategic location ensures a smart seasonal rental investment.

With high tourist demand and the digitalization of real estate services, mountain second homes are becoming high-potential assets. But every parameter of this equation must be optimized.

Why invest in rental real estate in 2025?

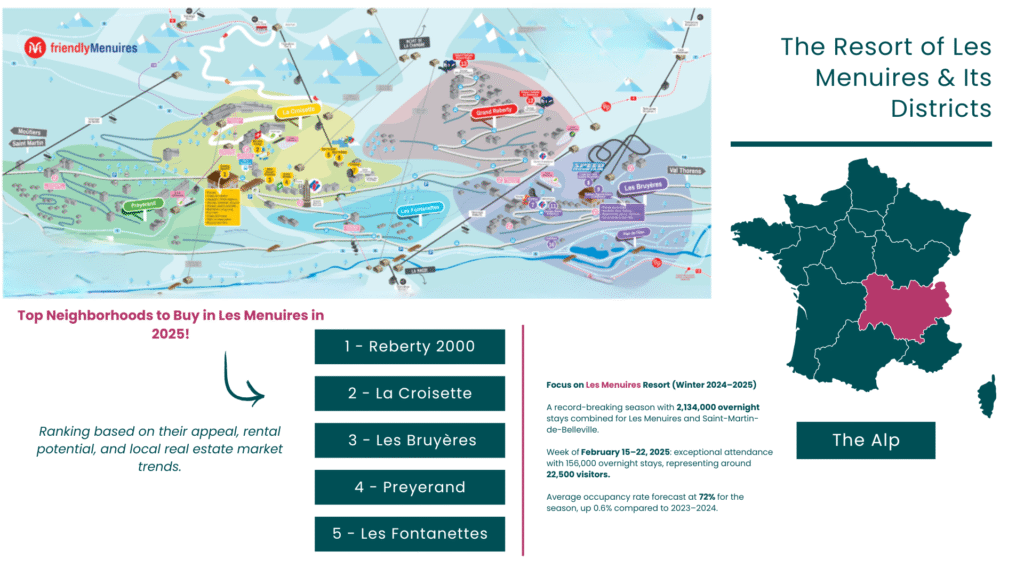

The mountains, especially the 3 Vallées resorts, are experiencing record attendance both in winter and summer. Tourists are looking for well-located, comfortable, weekly rentals close to the slopes. This digital transformation of tourism, combined with technological advancements in booking management, increases the appeal of seasonal rental investment.

Investing in Les Menuires means:

- Acquiring a property in a year-round dynamic resort

- Generating rental income during high and mid-seasons

- Enjoying personal use during the off-season

- Enhancing a real estate investment in a high-demand tourist area

The different types of profitability (gross, net, net-net)

- Gross profitability: the ratio between seasonal rents received and the property purchase price.

- Net profitability: includes deductible costs (maintenance, HOA fees, insurance, etc.).

- Net-net profitability: reflects the real return after real estate taxation.

In Les Menuires, a well-located apartment can yield between 4% and 6.5% net profitability, depending on the rental period and expense optimization.

Tips to improve your profitability

- Prioritize ski-in/ski-out locations, which are in high demand

- Upgrade interior design and amenities to appeal to premium clients

- Implement an efficient online booking system

- Outsource rental management to local professionals

- Target families or international guests with a unique offer

Mistakes to avoid that could hurt your rental yield

- Underestimating seasonality (vacancy during off-peak periods)

- Poorly evaluating maintenance and HOA fees (elevators, heating)

- Ignoring rental taxation specific to furnished rentals

- Buying in an area with poor access (far from lifts or shops)

Taxation of rental investment: what regimes to consider

Actual or micro-tax regime: which to choose?

For furnished seasonal rentals, the LMNP (Non-Professional Furnished Rental) regime is the most relevant. Two fiscal options exist:

| LMNP Regime | Conditions | Advantages | Disadvantages |

| Micro-BIC | Revenue < €77,700/year | 50% standard allowance | No deduction of actual costs |

| Real simplified | Revenue > €77,700 or by choice | Deduct expenses + depreciation | Requires accounting |

👉 In 90% of cases, the real regime is more beneficial. It allows for depreciation of the property, furniture, and renovations—significantly reducing or even eliminating rental income tax.

Spotlight on tax reduction programs (Pinel, LMNP, etc.)

In ski resorts, new developments are often eligible for LMNP with VAT recovery.

- LMNP in serviced residences: delegated management with commercial lease

- Classic LMNP: management freedom and tax optimization

- Censi-Bouvard (less common): tax reductions in managed residences

Programs like Pinel are unsuitable for mountain areas since they apply to year-round rentals in high-demand zones, which does not match the tourism model.

How to optimize costs and taxes

- Choose the LMNP real regime

- Deduct all costs related to the rental (loan interest, deductible charges, management fees)

- Depreciate the property over 20 to 30 years

- Reduce capital gains tax on resale through long-term ownership

Location: the decisive factor for real estate investment success

Key criteria for selecting the right resort or neighborhood

- Immediate proximity to slopes

- Altitude (resorts above 1800m to ensure snow coverage)

- Services nearby (ski schools, shops, activities)

- Accessibility (roads, shuttles, parking)

- Orientation, view, sunlight exposure

High rental yield resorts in 2025

Focus on Les Menuires – Part of the world’s largest ski area (3 Vallées), this resort ticks all the boxes:

- Ideal altitude: 1,850m

- Ski-in/ski-out station

- French and international clientele

- 4-season development: booming summer activity

Case study: same property, different yields depending on location

| Neighborhood | Price/m² | Peak Week Rent | Gross Yield |

| Reberty 2000 | €5,800 | €1,250 | 7.4% |

| La Croisette | €5,200 | €1,050 | 7.0% |

| Outlying Area | €4,500 | €750 | 5.2% |

Rental yield varies significantly based on location, even within the same resort.

Applying the winning trio: combining profitability, taxation, and location

Concrete strategies for a high-performing investment

- Buy a property to renovate and furnish for LMNP with real taxation

- Choose high-altitude resorts with guaranteed snow

- Rent during peak periods (Christmas, February, March, summer)

- Outsource management to track performance rigorously

Example of an optimized investment

Studio for 4 – Les Menuires – Reberty

| Element | Value |

| Purchase Price | €140,000 |

| High Season Weekly Rent | €1,100 |

| Weeks Rented/Year | 14 |

| Annual Revenue | €15,400 |

| Charges (HOA, maintenance) | €2,600 |

| Net profitability | 9% |

| Estimated LMNP Tax (real) | €0 for 8–10 years |

With a well-planned strategy, net-net profitability can be exceptional—without sacrificing quality or investor peace of mind.

Frequent mistakes when ignoring one of the three pillars

- Focusing only on profitability: poor location or untapped tax optimization → illusory yield

- Focusing only on taxation: new property but unattractive → low occupancy

- Focusing only on location: poorly configured studio → high vacancy rate

Succeeding in rental investment: key takeaways

Real estate in resorts combines profitability, personal enjoyment, asset transfer, and tax optimization. But to succeed, all three pillars must work together: profitability, taxation, and location.

📌 Key points to remember:

- Invest in a furnished, well-located, well-managed property

- Embrace a digital vision of the customer journey (bookings, monitoring, feedback)

- Optimize LMNP taxation to eliminate rental income tax

- Track your key performance indicators using data tools

- Think long-term: capital gains, property value, organic listing of your ad

We support our clients through every stage of their project in Les Menuires: acquisition consulting, seasonal rental management.

Do you have a project? Let’s discuss a rental investment that combines profitability, taxation, and premium location.

Charly.G