Investing in a chalet in Saint-Martin-de-Belleville in 2026: when Savoyard charm delivers a 6.2% return

Three years ago, Mathilde and Thomas sold their Paris apartment in the 11th arrondissement for €485,000. With that money, they bought an 85 m² chalet in Saint-Martin-de-Belleville, built entirely of wood and exposed stone, with views over the Belleville valley and true ski-in/ski-out access.

“Our friends thought we were crazy,” says Mathilde, a communications consultant. “Leaving Paris for a mountain village—they just didn’t get it. Especially since we had never made a rental investment before.”

Today, their chalet generates €32,400 net per year, a yield of 6.7%, far higher than any Parisian investment. And they spend six weeks there every year.

“Honestly, we should thank the people who tried to discourage us. It forced us to dig deeply into the subject, and we realized we were sitting on a gold mine.”

Saint-Martin-de-Belleville is not Courchevel.

It’s not Méribel either. And that’s exactly what makes it strong in 2026: an authentic village, listed among Les Plus Beaux Villages de France, nestled in the heart of the Three Valleys, where you can ski 600 kilometers without ever encountering the brutalist architecture of the 1970s.

Above all, it offers a real estate market that combines high rental yields, solid capital appreciation, and timeless charm. So—is this a passing trend or a genuine opportunity?

We spent two months analyzing the numbers, interviewing local agencies, and combing through listings. Here’s what we discovered.

Why Saint-Martin is driving occupancy rates through the roof (and more)

First observation: Saint-Martin-de-Belleville shows an average occupancy rate of 34 weeks per year for well-managed chalets, compared to 28 weeks for the average Savoyard resort. Data from Compagnie des Alpes for the 2024-2025 season is unequivocal: authentic chalet villages outperform concrete resorts. Vacationers are looking for experiences, not just ski slopes.

“What’s happening in Saint-Martin is a rare convergence,” explains Céline, Head of Communications at Agence des Alpes. “You have the Three Valleys ski area, meaning maximum sporting appeal. You have architectural authenticity, meaning a premium mountain experience. And prices that are still 30 to 40% lower than Courchevel or Méribel-Village for comparable properties. Investors understand it: it’s the perfect sweet spot.”

Concretely, a well-located 100 m² chalet in Saint-Martin rents for between €2,800 and €4,500 per week in high season (February holidays, Christmas–New Year), versus €1,400 to €2,200 in mid-season (January, March, early April).

Do the math: 8 high-season weeks at €3,500, 16 mid-season weeks at €1,800, 6 low-season weeks at €900, and you reach €62,200 in gross annual income. Deduct 30% in expenses (property management, maintenance, property tax, condominium charges), and you’re left with around €43,500 net.

For a chalet purchased at €650,000, that’s a gross yield of 9.6% and a net yield of 6.7%. Find better within Paris city limits—we’re waiting.

The story of Mathilde and Thomas: from anxiety to jackpot

Let’s go back to Mathilde and Thomas. Their purchase in February 2023 was anything but obvious.

“We had zero experience in the mountains,” admits Thomas, an aerospace engineer. “I’m originally from Bordeaux, Mathilde from Lyon. We skied two or three times a year, no more. But we had been following the Paris real estate market for years and could clearly see we’d hit the ceiling. A three-room apartment at €485,000 in the 11th arrondissement was our absolute max. And for what? 62 m², courtyard view, Voltaire metro. No prospect of capital appreciation.”

The trigger came during a stay in Val Thorens in early 2023.

“We thought: what if we bought in the mountains? We could rent it out in winter, enjoy it in summer, and maybe even generate income.”

They started searching first in Val Thorens (too expensive), then Les Menuires (too impersonal), before stumbling upon Saint-Martin-de-Belleville by chance while extending a weekend stay.

“It was love at first sight,” Mathilde recalls. “The village, the wooden façades, the baroque church, the cobbled streets it looked like a postcard. But the real turning point was visiting the chalet we eventually bought. 85 m², three bedrooms, living room with fireplace, south-facing balcony overlooking the Pointe de la Masse. The owner showed us his rental figures: 31 weeks rented the previous year, €29,500 in gross income. We couldn’t believe it.”

They purchased it for €480,000 in March 2023, financed 60% with a 20-year loan at 3.2%, and entrusted us with rental management for an 18% commission.

First full season (winter 2023-2024): 33 weeks rented, €34,800 gross income.

Second season in progress (winter 2025-2026): already 28 weeks booked by November, with projections of €38,000.

“We repaid €14,400 of the loan in the first year with rental income alone,” Thomas explains. “If it continues like this, the property will be fully paid off in fifteen years—and in the meantime, we enjoy six weeks of free holidays every year. Honestly, it’s the best investment we’ve ever made.”

What stands out in their story is the absence of regret.

“Of course, we sometimes miss Paris,” Mathilde admits. “But financially and emotionally, we feel we made the right choice. And we kept a pied-à-terre with friends for our visits. The rest of the time, we enjoy the mountains and know our money is working for us.”

3 opportunities not to miss (Agence des Alpes selection)

Here’s a snapshot of what we currently offer. Be warned: in this sector, properties rarely stay on the market longer than 15 days.

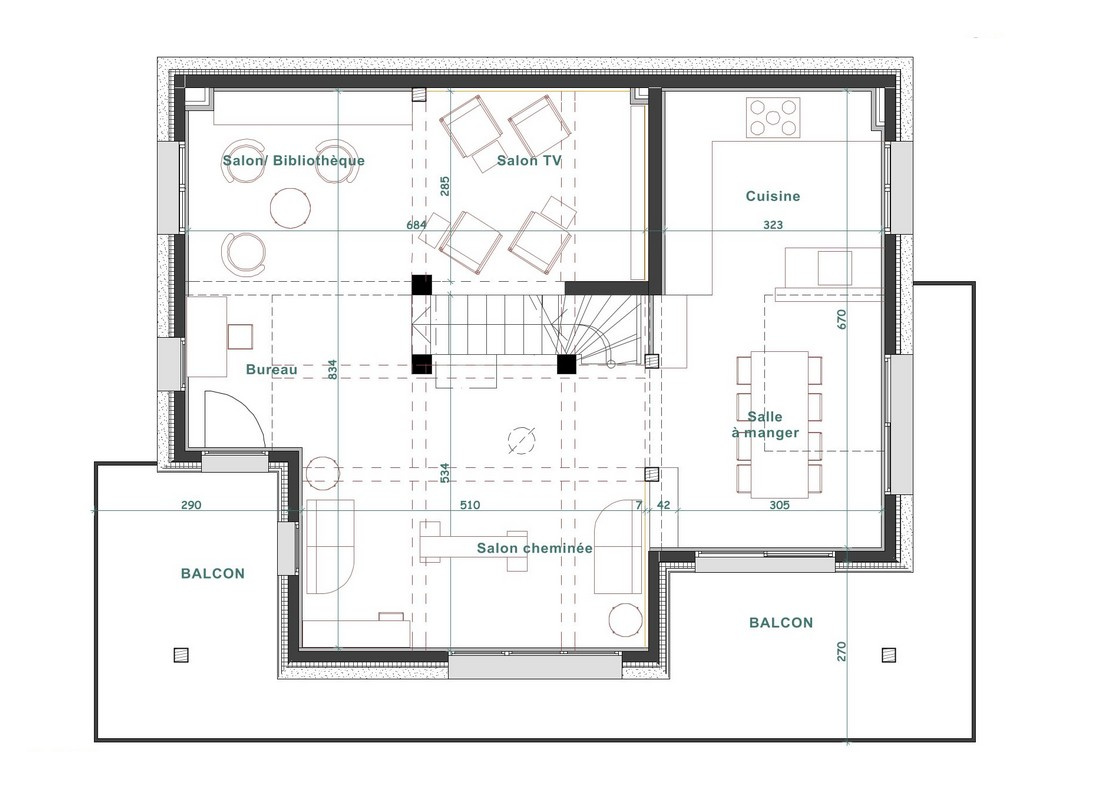

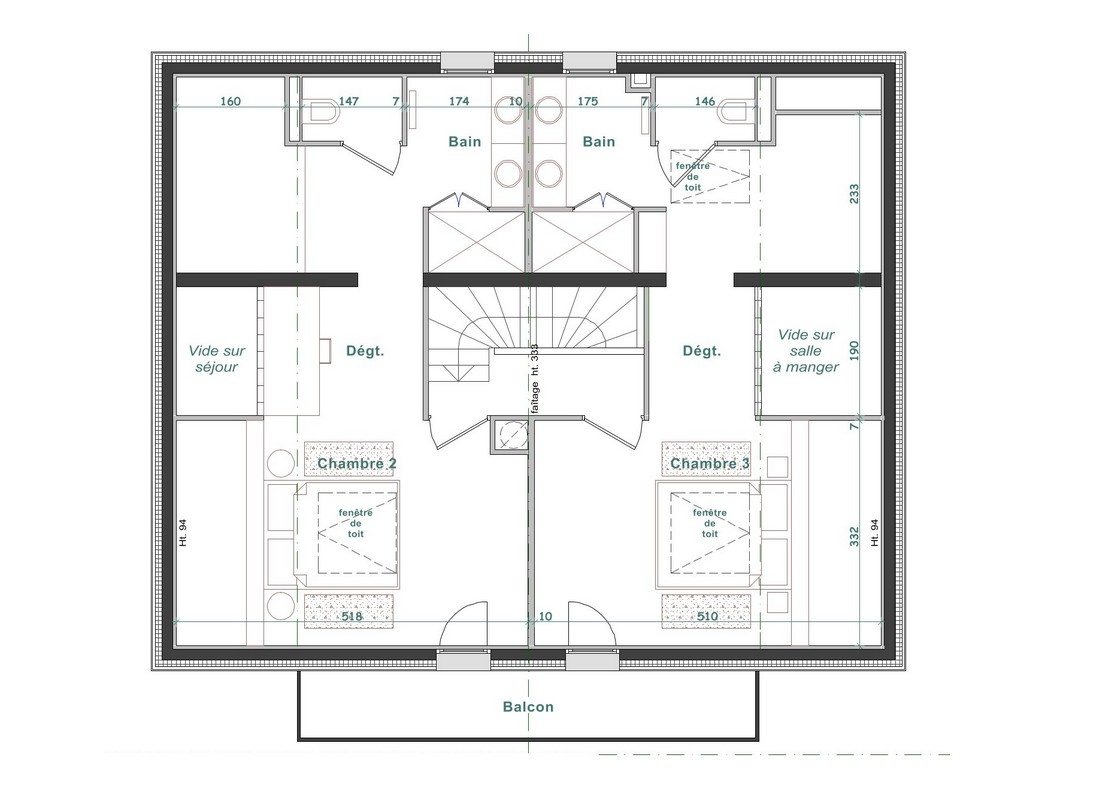

Authentic alpine chalet Lechaux: Nestled in an exceptional natural setting, this traditional alpine chalet enjoys a prime location on the slopes of Saint-Martin-de-Belleville.

Detached chalet in Le Bettaix: Located in the peaceful and authentic village of Le Bettaix, offering southwest exposure with views over the village, 650 m from the slopes.

Detached chalet close to the slopes: Situated in Le Bettaix, a charming village with a chairlift directly connected to the Three Valleys ski area. Built in 2012, this chalet offers 179 m² over two levels.

The real profitability numbers (beyond the brochures)

Let’s talk money. Investing in a chalet in Saint-Martin-de-Belleville isn’t just a lifestyle choice—it’s a financial calculation that must hold up over 15 to 20 years. Here are the key parameters observed in 2026.

Average purchase price: Between €6,500 and €8,200 per m² for a well-located traditional chalet. A 90 m² property therefore ranges from €585,000 to €740,000. Renovated older chalets pull prices down (€5,800 to €6,500/m²), while high-end new builds push them up (€8,500 to €10,000/m²).

Rental income: A 90 m² chalet generates between €50,000 and €68,000 gross per year with optimized management (mix of high, mid, and low season). This assumes 30 to 36 weeks of occupancy—entirely achievable in Saint-Martin with good visibility (Airbnb, Abritel, local agencies).

Expenses to anticipate:

Rental management: 15–20% of income (agency) or 8–12% (concierge only)

Maintenance/repairs: 5–8%

Property tax: €900–€1,500

Condominium charges: €1,000–€2,200

Insurance: €600–€900

Total: around 28–32% of gross income goes to expenses.

Realistic net yield: Between 5.8% and 7.2% for a well-managed property bought at market price. That’s two to three times higher than classic city rentals (Paris: 2.5%, Lyon: 3.8%).

Capital appreciation: Over the last ten years, Saint-Martin-de-Belleville recorded average annual appreciation of 4.1% (source: Notaires de France, January 2025). A chalet bought for €600,000 in 2016 is now worth around €895,000. Note: 2020-2023 saw a post-Covid surge (+6.8%/year) that has since stabilized. Projections for 2026-2030: +2.5 to 3.5% annually, more in line with inflation.

“The classic trap is underestimating expenses,” warns Élodie. “Owners think they’ll manage everything themselves cleaning, check-ins, maintenance. In reality, if you live 500 kilometers away, it’s unmanageable. A good agency or concierge costs money, but it secures your income and prevents lost bookings due to slow responses.”

Why Saint-Martin is more resilient than other resorts

February 2025: Storm Eowyn sweeps through the Alps. Several mid-altitude resorts especially in Isère and the Hautes-Alpes temporarily close due to insufficient snow. In Saint-Martin-de-Belleville: 115 cm at 1,450 m, 185 cm at 2,850 m. All slopes open, lifts running normally.

“That’s where you see the difference,” comments a British tenant interviewed on site. “I paid €3,200 for my week, I have snow, sunshine, and access to 600 kilometers of slopes. My colleagues who went to the Pyrenees spent three days playing cards.”

This climate resilience is no coincidence. Saint-Martin benefits from a northeast exposure in the Belleville valley, with terrain rising to 2,850 m (Pointe de la Masse) and extending to 3,230 m toward Val Thorens. Result: reliable snow from early December to mid-April 19 exploitable weeks versus 14 to 16 for mid-altitude resorts.

“Savvy investors look very closely at this,” says Céline. “With climate change, resorts that maintain snow cover will see their value explode. Saint-Martin is a safe-haven investment. You have altitude, massive investment in snowmaking (€48 million between 2020 and 2024), and real summer-winter diversification. Owners who also rent in summer reach 38 to 42 weeks per year. That’s just stratospheric.”

Summer is indeed booming. Data from the Belleville Tourism Office shows a 23% increase in summer attendance between 2022 and 2025. Rental prices are rising: €1,200 to €1,800 per week in July–August, compared to €600–€900 five years ago.

Pitfalls to avoid (and there are many)

Investing in a chalet in Saint-Martin is not risk-free. Here are the most common mistakes seen on the ground.

Mistake #1: Overpaying due to emotion. Savoyard charm can cloud judgment. Some buyers pay 15–20% above market value. “We’ve seen people buy at €8,500/m² for properties worth €7,000,” says Céline. “Three years later, they’re stuck when trying to resell.”

Mistake #2: Ignoring common areas. A chalet in a condominium includes shared roofs, façades, heating systems. Poorly funded co-ops lead to surprise capital calls.

Mistake #3: Underestimating seasonality. Saint-Martin is quiet in spring and autumn. Realistic owners plan for 30–36 rental weeks.

Mistake #4: Choosing a remote location to save money. A chalet 2 km from the center without shuttle service can lose 20–30% of demand.

Mistake #5: Self-managing from afar. A leaking pipe on a Saturday night can’t be handled by phone. Many owners eventually give up—after losing bookings and online ratings.

Taxation: LMNP, LMP, or SCI? (the simplified puzzle)

A furnished rental chalet can quickly become a tax maze. Here are the main regimes in 2026.

LMNP (Non-Professional Furnished Rental): Default regime if rental income is under €23,000 or less than 50% of total income. Allows depreciation, drastically reducing taxable income. Requires accounting support (€800–€1,200/year).

LMP (Professional Furnished Rental): Above €23,000 and over 50% of income. Same depreciation, deficits deductible from global income, potential capital-gains exemption after five years. Downside: social contributions (~30%).

SCI (Real Estate Company): Useful for joint purchases. No depreciation unless taxed under corporate income, which complicates resale.

“For a typical investor buying a €600,000 chalet generating €50,000 gross, LMNP under the real regime is often best,” says Céline.

Crucial point: classified tourist furnished rentals benefit from a 71% allowance under micro-BIC (vs. 50% otherwise). Nearly all chalets in Saint-Martin qualify. That’s €3,000–€4,000 less tax per year on €50,000 of income.

The questions every buyer asks (and our answers)

Will Saint-Martin withstand climate change?

Yes, in the short and medium term. Altitude, snowmaking, and diversification secure the model until 2040–2050.

Can you live off chalet rentals?

Difficult. But as supplemental income or early retirement support, it’s viable.

New or old?

Renovated older chalets often offer the best value.

Best time to buy?

Spring and autumn.

Time to break even?

12–15 years including rental income and appreciation.

Will prices keep rising?

Likely, but more moderately: +2.5–3.5% annually.

What the numbers don’t show (but matters just as much)

Beyond returns, there’s personal use. “Those six weeks we spend there are priceless,” say Mathilde and Thomas. “They’d cost €12,000–€15,000 a year to rent. So our real yield is closer to 9–10%.”

And there’s legacy. “In twenty years, this chalet will belong to our kids. It’s tangible wood, stone, memories.”

Saint-Martin in 2026: still a good idea?

The numbers speak clearly: 6–7% net yields, solid capital appreciation, an exceptional ski area, and sustained demand. Hard to find better in the French Alps in 2026 if you buy wisely.

The best time to buy was five years ago. The second-best time is now. Especially when it comes to a village that has crossed three centuries without losing its soul.